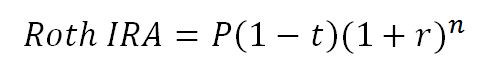

Well, with April here, spring in the air, flowers blooming and tax time looming, we thought we would dispel a misconception about the Roth IRA first time home buyer’s reduction in earnings while taxes are fresh in the mind of half the population.

We’ve seen this lately being mentioned as an advantage of a Roth IRA here, here and here. And, we’ve attempted to alert some of them to the complexity of this acrobatic maneuver they suggest. Some willing to learn, but mostly with us being shrugged off. So, we thought we would move it to a stage where we can fully (at least attempt to) explain this complex tax move.

First, we should point out, that we think using an IRA for anything else other than retirement is a mistake. GASP! A blanket statement. They are powerful tools which help people to retire. In an indirect way, yes, buying a home does help one to retire, or paying for a child’s college education (if that is an expense you decide to bear) does help you to retire. But, there are other ways to help you save for those things. Look at it this way, you only get $5000/yr (under current rules) to contribute. Maxing this out year after year will barely get you into retirement, if ever. Use a wrench to turn nuts & bolts, and a hammer to pound nails. So, even if you read through what we are about to say and still think saving for a home in a Roth IRA is a good idea, you certainly don’t have our endorsement. But, our opinion is worth what you paid for it (should we set up a paypal link for some luv?).

The origin of the Roth IRA first time home buyer’s earnings distribution misconception is the interwebz. It is undoubtedly true that you can withdraw from a Roth IRA, an amount up to $10,000 for the purchase of a primary residence to be your “first” home (usually if you haven’t owned a home in two years, you are a born again “first” time home buyer). We would certainly hope everyone would due their do diligence (why do we feel like we messed something up there?). And, if you want a great summary of why most people think this is an easy peasy tax move, read Publication 590, page 62, bottom right of the page. It is right there, plain as day under big bold words that say, “What are Qualified Distributions”:

One that meets the requirements listed under First home under Exceptions in chapter 1 (up to a $10,000 lifetime limit).

And if you’re looking at the Pub 590 document that we link to, page 62 and you click on the hyperlink of “first home,” then it takes you to the part where it defines who you can buy a home for, what defines a “first” home and even points out that you and your spouse can both do this for the same home!

This is a qualified distribution, so the normal roth ordering rules don’t apply (rules which say when there is a non-qualified distribution that you first take out your contributions, then conversions-this has a few caveats-and then earnings). Being a qualified distribution, you can take from the earnings. If you think you can have your cake and eat it too by keeping your contributions as an emergency fund and reducing your earnings for the home purchase you are WRONG! You will have to reduce your basis (or contributions) by the amount of earnings you withdrew the prior year for a first time home purchase, up to $10,000.

Sounds confusing, well it is. Let’s look at some tax forms. To do this, we must go back to 2010 so you can see how this works. For our example we’ll assume you have $30,000 in a Roth IRA, $10K of earnings and $20k of contributions. Let’s say you want to tap that $10k of earnings for a home in 2010. First off, you must have a Roth IRA account at least 5 years old. Withdrawing anything before that can trigger taxes and penalties. But, what is so lucrative about using the earnings instead of the contributions? The main reason is so in our example, you could take all $30k out for a home purchase, tax and penalty free. But, if you aren’t going to completely wipe out the account, you are not gaining anything (and some would argue you are loosing things).

One of the hard sells of Roth IRA’s are their flexibility. And they are the Gumby of retirement investment vehicles because contributions can be tapped, tax and penalty free. If you like this about a Roth, here is why you need to be cautious with this first time home buyer deal. Let’s assume you take the $10k of earnings in our example above in 2010 for the purchase of your first home. You would fill out the 2010 form 8606 like so…

That’s it. You can download this 2010 8606 form here. The 2010 form is a little more complicated than other years because of being able to allocate taxes due on conversions over two years, but all that is in Part III.

So, in 2011 (or any year into the future), let’s say you want to take out the $20k of contributions, for whatever reason. Let’s fill out your form 8606 in 2011. This is what it would look like (oh, and you’ll need the instructions, linked here for your pleasure).

WHOA! What just happened? How did you end up with taxable money in line 36? Should line 22 be $10,000?! OR $20,000? As they say, the devil is in the details. Let’s look at those instructions for the 2011 8606, line 22.

Figure the amount to enter on line 22 as follows.

- If you did not take a Roth IRA distribution before 2011 (other than an amount rolled over or recharacterized or a returned contribution), enter on line 22 the total of all your regular contributions to Roth IRAs for 1998 through 2011 (excluding rollovers from other Roth IRAs and any contributions that you had returned to you), adjusted for any recharacterizations.

- If you did take such a distribution before 2011, use the chart on page 9 to figure the amount to enter.

We hop to page 9 and find the following chart.

So, using this chart on page 9 of form 8606 instructions for 2011, if we took a distribution for a first time home buyer in a prior year, we must take that off of our Roth basis in the following year (2010 8606 line 29 less line 26). Essentially, the Roth ordering rules are restored and the Roth basis (contributions) is reduced by the amount used for the home buyer’s distribution in any following year you take a distribution. You can find the 2011 8606 form here.

If you were planning on having an emergency fund and use a home buyer distribution within your Roth accounts, it would be wise to treat the home buyer distribution as being from the basis. In fact, it would be wise, if you aren’t wiping out the entire amount of Roth funds, to take from the basis and save yourself not only a headache, but your lifetime $10,000 home buyer distribution from any IRA. The wisest thing you could do, however, is not touch your retirement accounts until needed in retirement.

And you should check out our legalese page to know we are not professionals at anything, except maybe at barking. H&R block won’t even hire us to prepare 1040EZ’s. So, talk to them or a real tax professional.